two) On Loss of life of your life assured after the commencement of your payout interval, Sum confident on Loss of life is payable as lumpsum to the nominee or legal heir on the lifetime certain and also the nominee or authorized heir shall go on to receive the longer term Guaranteed Revenue in the payout period of time.

@Overall Premiums obtained/paid out signifies full of every one of the premiums gained, excluding any excess high quality and applicable taxes

Registration as an investment adviser does not suggest a certain amount of ability or teaching, and the content material of this interaction hasn't been accredited or confirmed by the United States Securities and Exchange Fee or by any state securities authority.

This product is intended to deliver the lifestyle assured a fixed daily life insurance coverage protect all over the coverage time period.

When you are like numerous, you could possibly believe getting life insurance requires a overall health exam. Find out more about an easier route to getting daily life insurance policies.

Pay premiums for Confined phrase or as Single Payment, as per your usefulness and enjoy Added benefits through the plan phrase. Two protection choices :

On completion of policy term, provided the plan is in drive, you will get the upper of (Fund Value as about the day of maturity/vesting Moreover one.5% from the maturity/vesting fund worth will be compensated as Terminal Addition) OR (101% of total premiums paid out) The maturity gain can be used to purchase annuities with the complete volume or possibly a Section of it.

There's an option for the nominee/authorized heir, ahead of the thanks day of the following installment of the Sensible Rewards, to get discounted value of the long run owing installment(s) of Wise Benefits in the lump sum amount of money.

The merchandise offers a death benefit pay back-out in case of the Dying in the life certain. For all times Assured with entry age down below 8 decades: On Dying of the insignificant lives ahead of the date of commencement of chance underneath the policy, the corporation will pay the Fund Benefit as over the date of intimation of the assert to the corporation. On Demise on the slight life on or following the day of commencement of threat, the business pays the Loss of life profit as described below for age at entry 8 years and previously mentioned. For all times Assured with entry age eight years and previously mentioned: On Dying on the Life Confident with entry age 8 many years and over, the business can pay the Dying advantage as described underneath.

* A non-smoker wholesome male of 22 a long time, Investment of ₹2500 per 30 days less than Progress Strategy selection, 20 years policy phrase enjoys maturity benefit of ₹.seven.sixty eight lacs (@assumed fee of return 4%)^^ & ₹. 11.eighty five lac (@assumed amount of return eight%)^^. Bare minimum every month high quality volume allowed to start out your insurance plan prepare. Development & Well balanced are depending on General publicity to equity, personal debt and funds current market devices during policy term. Tax Rewards are as per Revenue Tax Regulations & are matter to vary every now and then. Please talk to your Tax advisor for particulars. Fund Worth figures are for illustrative applications & for healthier life. Remember to Take note that the above described assumed fees of returns @4% and @8% p. a., are only illustrative scenarios, just after contemplating all relevant fees. These are typically not assured and they are not larger or decreased restrictions of returns. Device Connected Daily life Insurance items are matter to market place risks. The different cash available underneath this contract are the names of the resources and do not in almost any way suggest the caliber of these ideas and their foreseeable future prospective clients orreturns. To find out more, request in your plan unique gain illustration. Device Connected Life Insurance policy items are different from the normal products and solutions and they are subject matter to market place pitfalls.The top quality compensated in Unit Connected Insurance policies guidelines are topic to investment risks associated with money marketplaces and also the NAVs with the models could go up or down dependant on the functionality of fund and factors influencing the money current market plus the insured is to click for source blame for his/her straight from the source choices.

Triple Protection In the event of any unlucky insured function in the time period with the policy, Listed below are a few ways in which this child approach can offer protection : • Instant Payment : The sum confident to the insured occasion is payable as a lump sum to the occurrence of your respective occasion. • Waiver of Thanks Top quality : In celebration of an unforeseen situation that brings about your absence, all the future high quality instalment(s), if any, might be waived off. • Clever Reward : Due instalment(s) of Intelligent Positive aspects are payable and along with the very last instalment of wise profit, a Terminal Bonus, if declared, is going to be compensated. Adaptable Premium Payment Phrase

The nominee or authorized heir shall have an option to obtain the discounted value of the future Confirmed Money, in the shape of the lumpsum, whenever over the Payout Interval, discounted at eight.25% for every annum. In which sum assured on Demise is larger of the following:

SBI Lifestyle- Saral Jeevan Bima is someone, Non-Joined, Non-Participating Lifetime Insurance coverage Pure Threat Quality Solution. This approach is apt for initial-time lifetime insurance policies consumers. Guard your dependents Once you are long gone In the event the daily life confident passes away throughout the coverage phrase, following the expiry of your ready period of time or as a consequence of incident over the waiting around period of time, the nominee / beneficiary will get the Sum Certain on death, in lumpsum, that is: For Regular and Confined High quality payment procedures it really is greatest of: - ten periods the Annualized premium1 - a hundred and five% of all premiums compensated as to the day of Loss of life - Complete amount of money certain+ to become compensated on Demise For Solitary quality procedures it's better of : - one hundred twenty five% of One top quality - Complete quantity certain+ to become paid out on Dying On death on the life assured resulting from other than accident, through the waiting around period of time, the nominee/beneficiary will acquire the Dying Benefit, which can be equal to a hundred% of every check my blog one of the premiums compensated, excluding taxes, if any 1 Annualized High quality is the entire degree of premium payable in the plan year, excluding taxes, underwriting added rates and loadings for modal rates,if any.

• The policyholder has an choice to make partial withdrawals from their plan to deal with their emergencies, provided the policy is in drive and post completion of lock-in interval. Partial withdrawal : a) is often created only following completion of lock-in interval.

The plan gives you the flexibleness to change the investment tactic around 4 situations in the whole coverage phrase.

# Full Rates paid indicates whole of the many rates compensated underneath the foundation products, excluding any extra premium and taxes, if collected explicitly Tax Advantages

Rider Strong Then & Now!

Rider Strong Then & Now! Marla Sokoloff Then & Now!

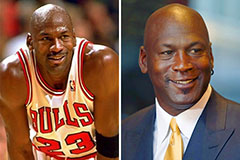

Marla Sokoloff Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!